Informed Momentum®

We believe the momentum premium can be effectively delivered through our Informed Momentum® investment advisory services.

Investment Philosophy

We believe the momentum premium can be effectively delivered through our Informed Momentum® investment advisory services. This belief is supported by three central tenets:

Momentum | Momentum is a significant source of alphaEmpirical evidence demonstrates that the momentum premium is both significant and persistent. We believe momentum’s strength as a source of alpha is due to its inherent adaptability through time and its ability to signal improving company growth prospects. |

Rationale | Behavioral inefficiencies create the opportunityWe believe that investor behavior best explains the momentum premium and alpha creation. Namely, investors display consistent behavioral biases around new information culminating in a chronic under/overreaction that creates mispricing. Further, we believe that innovation and reinvention at the company level power the dynamics that enhance behavioral biases. In addition, they underwrite improving financial performance, thus reinforcing the prospects for continued outperformance. |

Risk Management | Actively addressing risk retains alphaWe believe that alpha can be fleeting as investor expectations inevitably shift through time. This dynamic requires disciplined and sustained action on portfolio constituents to preserve outperformance. Further, we believe intended and compensated portfolio exposures must be preserved to generate and retain alpha. |

Informed Momentum |

Investment Process

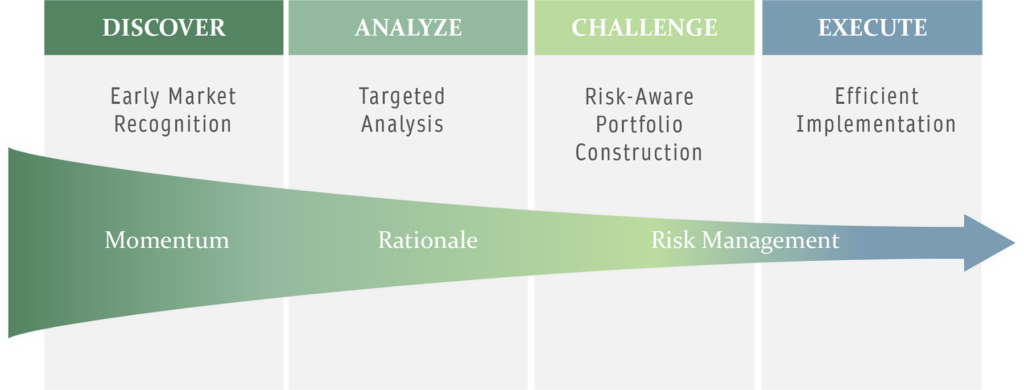

We believe our systematic approach to discovering ideas, focused analysis, timely decision making and efficient implementation are the keys to maximizing available alpha and achieving consistent results.

All of our strategies employ the same daily, bottom-up investment process that is disciplined and objective. The process consists of four distinct actions – Discover, Analyze, Challenge, and Execute.

ESG

We remain committed to analyzing ESG risks and opportunities within the context of our Informed Momentum® investment approach. Within our targeted company analysis, ESG considerations are assessed to determine whether they may have a material impact on the success of that company and its investment returns.